Home buyers of Pittsburgh

Unfortunately, the Pittsburgh Home Ownership Program (PHOP) is temporarily closed. Fortunately, the State of Pennsylvania has terrific loan programs for first and non-first-time home buyers, including closing cost/down payment assistance. Read more

City of Pittsburgh first-time home buyer program requirements

Eligibility

Eligibility

You must own and occupy the City of Pittsburgh home. It may have 1 to 4 residential units. Your income and the purchase price must not exceed the limits. If you are purchasing in a program area you must be either a first-time homebuyer or haven’t owned a home in the past three years. The borrower will also have to pay approximately a $300 fee for an application and a credit report. If you receive a Down Payment Closing Cost Assistance Grant, you will need to attend a home buyer's education class.

Occupancy

You must occupy the property purchased as a primary residence - no investors

| 1 - Unit | $248,900 |

| 2 - Units | $280,340 |

| 2 - Units | $340,600 |

| 4 - Units | $393,000 |

- Maximum Sales Price - Approximately $298,481

- Mortgage Program - FHA

- Minimum Down Payment - 3 1/2% (FHA)

Income qualification

You must be a first-time home buyer or not owned a home within the previous three years and meet the household income limits in non-targeted area.

- Term - 30-years only

- Eligible Areas - All areas of the City of Pittsburgh

Property Types

Must be a single-family residence. Condominiums, townhouses, and mobile homes permanently affixed to a Borrower's individually owned lot are eligible. Houses that include rental space or commercial space are ineligible.

Home buyer counseling

Participants' maybe required to obtain pre-purchase credit counseling (Homebuyer Education Counseling). A Certificate of Completion must be submitted to the mortgage company to be made a part of the Borrower(s) loan file. An acceptable Certificate of Completion may be obtained by the Borrower(s) from a PHFA or HUD certified counseling agency. Participants will also be required to meet with a Counselor for a one on one counseling session to go over budget, credit, mortgage financing, and home ownership responsibilities. The counseling session will last a few hours.

City of Pittsburgh closing cost and down payment assistance

City of Pittsburgh closing cost and down payment assistance

Participants in the First-Time Homebuyer Program may qualify for up to a maximum of $3,000 in Closing Cost and Down Payment Assistance Program.

Targeted Area Homebuyers Program

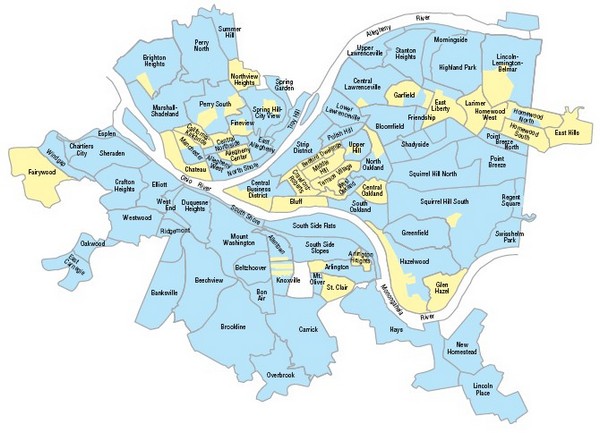

Prospective home buyers in the following census areas are not required to be first-time home buyers. All other requirements of the PHOP Program are applicable.

In target neighborhoods, there are no income limits and you do not have to be a first-time home buyer!.

Maximum Sales Price - Approximately $364,810

| TARGET NEIGHBORHOODS | |||

|---|---|---|---|

| Allegheny Center | Central Northside (Part) | Garfield (Part) | Manchester (Part) |

| Allentown (Part) | Central Oakland | Glen Hazel | Middle Hill |

| Arlington (Part) | Chateau | Hazelwood (Part) | North Oakland (Part) |

| Arlington Heights | Crawford Roberts | Homewood North (Part) | Northview Heights |

| Bedford Dwellings | East Hills | Homewood South | Perry South (Part) |

| Bluff | East Liberty | Homewood West | Spring Hill South |

| Brighton Heights (Part) | East Liberty (Part) | Knoxville (Part) | St.Clair |

| California Kirkbride | Fairywood | Larimer | Terrace Village |

| Central Lawrenceville (Part) | Fineview (Part) | Lincoln-Lemington-Belmar (Part) | West Oakland (Part) |

| Upper Hill (Part) | |||