Conventional 97 Loan and Calculator

With

great fanfare, the Federal National Mortgage Association announced

on December 8th, 2014 that Fannie Mae was reducing the down

payment percentage to 3% for qualified homebuyers (and homeowners

who wish to refinance). The new home loan program was rolled

out to compete with the FHA home loan. I read a number of articles

online that this low down payment mortgage was superior to

the FHA mortgage . . . but is it? I had my doubts. Here are

the details of the Conventional 97 compared to an FHA mortgage:

With

great fanfare, the Federal National Mortgage Association announced

on December 8th, 2014 that Fannie Mae was reducing the down

payment percentage to 3% for qualified homebuyers (and homeowners

who wish to refinance). The new home loan program was rolled

out to compete with the FHA home loan. I read a number of articles

online that this low down payment mortgage was superior to

the FHA mortgage . . . but is it? I had my doubts. Here are

the details of the Conventional 97 compared to an FHA mortgage:

- The applicant must be a first-time homeowner, or one of the applicants must be a first-time homebuyer in the event of joint applicants (i.e. husband and wife, partner/partner, etc.).

- A first-time homebuyer is someone who hasn't bought a house in the last three years.

- 3% down payment required

- The residence must be a single-family attached or

detached home, a townhouse, condominium, co-op, or row-home.

There are no duplexes, triplexes, or four four-unit structures allowed. - The loan amount is limited at 510,400.

- The 97 program has no income restrictions.

- Only a 30-year fixed-rate loan is available.

- Buyers must have a minimum credit score of 620.

- The 97 loan includes private mortgage insurance.

- Parent(s), grandparent(s), spouse, kid, or anyone else connected through marriage, blood, legal guardianship, adoption, fiancé fiancée, or a domestic partner are all eligible donors.

- The down payment and closing cost assistance must be given as a gift with no repayment plans.

- The seller covered the closing costs (seller assistance).

- The Conventional 97 allows the seller to pay up to 3% of the buyer's closing and prepaid costs (i.e. tax and homeowner's insurance escrow), with a down payment of 3% to 9%.

- With the Conventional 97, you may put down a higher deposit.

Sounds pretty good, right?

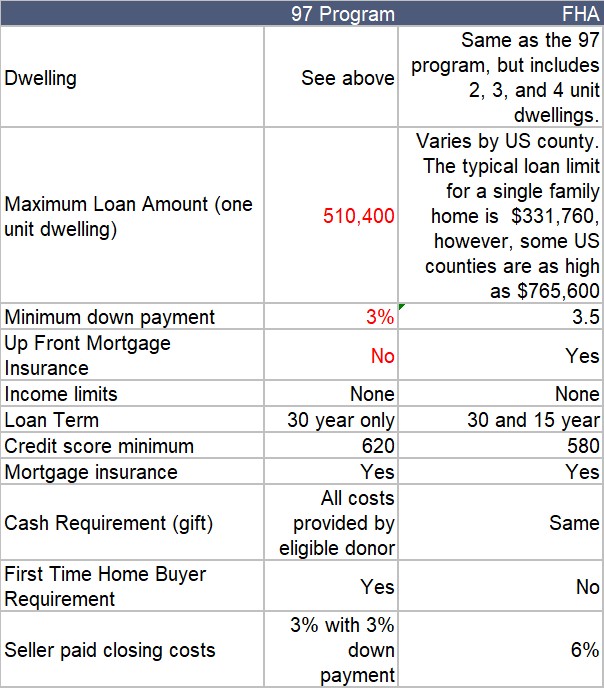

Here's a comparison of the FHA loan and Conventional 97 program:

The 97 program permits a larger loan amount in most US counties

($510,400), no upfront mortgage insurance and the down payment

is .5% lower than an FHA mortgage. But . . .

if the homebuyer needs the seller to pay a large percentage

of the settlement costs, then the FHA is better. The

credit score requirement is lower with an FHA mortgage/loan

and there are no first-time homebuyer requirements. The FHA

does not require the buyer to have additional money in cash

savings after settlement. The Conventional 97, 3% down payment

loan, (in most cases) requires cash savings. Let's compare the

monthly cost and down payment between these two loans:

Which is the better loan, an FHA, or conventional 97?

If your credit score is less than 740 - go FHA

If you are purchasing a duplex, triplex, or four-unit dwelling - go FHA

If you need the seller to pay closing costs - go FHA (6% limit)

If you need a co-signer - go FHA

The monthly loan payment with a FHA home loan is superior to the Conventional 97 loan because the monthly cost percentage is lower than the Conventional 97. The 97 loan always beats the FHA loan on down payment. The 97 loan is superior to the FHA mortgage when the loan amount exceeds the customary FHA 294,515 loan amount.

The Conventional 97 monthly mortgage insurance rates are based on the MGIC Borrower-Paid Monthly Premiums for National* – except AK, DE, GU, NE, NY, PR & WA as of 8/27/2018

HomeReady™ 3% down payment program

Fannie Mae also has the HomeReadyTM (previously MyCommunity)

program for low to moderate income home purchasers. The program is

essentially similar to the Conventional 97 loan, however the

HomeReadyTM loan includes income restrictions.

The borrower's income cannot exceed 100 percent of the area median

income (AMI), and the house must be in a moderate-income census

tract.

There are no restrictions for first-time home buyers!

The interest rate and mortgage insurance are cheaper than those seen

in other traditional house loans.

Read more